Medical debt can have a significant financial impact on homeownership, particularly in Oregon. Unpaid medical bills can lead to an increased risk of foreclosure for homeowners and make it difficult to obtain mortgage loans in the future.

This is especially true for those with lower incomes or poor credit scores, who may already be struggling with medical expenses. For those who find themselves in this position, taking the time to understand the rules that govern medical debt in Oregon can help protect their homes from foreclosure and provide them with more options when it comes to obtaining mortgages.

It is important to speak with an experienced attorney or financial advisor about any legal protections available for medical debts and how these might affect a homeowner's ability to obtain financing for a house purchase. Additionally, learning about the specific laws governing debt collection and foreclosure proceedings in Oregon can help ensure that homeowners are making informed decisions if faced with the potential of having their home taken away due to unpaid medical bills.

Medical debt can be a heavy burden. In Oregon, it can even lead to the loss of your home if you do not understand and abide by the rules.

The direct route to losing your home to medical debt is one with many potential pitfalls, so understanding the rules is essential for protecting yourself from this eventuality. Knowing that Oregon has specific laws regarding medical debt and how it affects homeownership can help you steer clear of any possible foreclosure due to unpaid healthcare bills.

Understanding what lenders and creditors are allowed to do in terms of collection activities, as well as the rights and protections afforded to borrowers, is vital for keeping your home safe from medical debt-related foreclosure proceedings. Even if you are already in default on medical bills or a creditor has begun foreclosure proceedings against your property, there may be options available for halting or reversing the process.

Being aware of all applicable legal limits on collection activities, payment plan options, and other methods of resolving medical debt in Oregon will help ensure that you don't lose your home due to an inability to pay off medically related expenses.

Medical debt is a serious issue that can have devastating consequences, including the potential loss of one's home. In Oregon, there are various regulations in place to protect homeowners from the threat of medical debt, but it is important to understand how these laws work and what indirect paths may lead to losing your home due to medical debt.

It is possible for a person in Oregon to be forced out of their home if they are unable to pay off debts incurred as a result of medical bills, even if they never took out loans or mortgages specifically for this purpose. For example, if an individual defaults on other types of loans or credit cards due to being unable to make payments while attempting to cover medical bills, creditors may attempt foreclosure proceedings against them.

Additionally, some lenders may consider missed payments caused by medical expenses when making decisions about loan applications from the same individual in the future. It is therefore essential for Oregon residents with medical debt to understand their rights and all potential paths that could lead them towards losing their home due to unpaid medical bills.

HomeGo is an essential tool to help Oregon residents protect their homes from medical debt. With HomeGo, individuals can take advantage of the numerous legal protections that exist in Oregon to help them avoid foreclosure and stay in their home during tough times.

HomeGo's experienced professionals can provide guidance on navigating the state's rules and regulations surrounding medical debt while providing personalized advice on how homeowners can best protect their home from creditors. HomeGo offers homeowners a comprehensive plan for reducing or eliminating medical debt, which includes utilizing all potential repayment options, including special state programs and loan modifications that could decrease monthly payments.

Additionally, HomeGo helps ensure homeowners understand all of their rights under Oregon law and are protected from any predatory practices by creditors who may attempt to take advantage of them. With the support of HomeGo, Oregon residents have a valuable ally in protecting their homes from medical debt.

When it comes to the prospect of losing your home to medical debt in Oregon, there are many questions that arise. One of the most common is whether a lender can take away your home if you are unable to pay your medical bills.

In Oregon, lenders cannot take away your primary residence if you fall behind on payments due to medical debt. However, they can put a lien on your property which could lead to foreclosure if not paid off in time.

It is important to understand the terms of any loan agreement and read all paperwork carefully before signing so you know what will happen should you be unable to make payments due to medical debt. Another question that arises is whether or not bankruptcy is a viable option for dealing with medical debt in Oregon.

Bankruptcy does provide some protection from creditors, however it does not erase all of your debts and may have an effect on your credit score for up to 10 years after filing. Therefore, it is important to consider all options before making a decision about how best to protect yourself and your home from medical debt in Oregon.

If you are facing medical debt in Oregon and are concerned about foreclosure or repossession of your home, it is important to evaluate the alternatives available. For example, Oregon offers mortgage forbearance programs that can help you stay current on your loan payments while deferring a portion of the payment for a certain time period.

Additionally, there may be options for refinancing or restructuring your loan in order to get better terms and more manageable payments. Before making any decisions, make sure you understand all the available options so that you can make an informed choice about what's best for your particular situation.

There are also government programs available to assist with mortgage payments and other costs associated with medical debt. It is important to explore all of these possibilities before taking action on any option.

When it comes to avoiding foreclosure or repossession of your home due to medical debt, selling your home may seem like the best option. However, there are several potential pros and cons of this decision that should be taken into account before making a final decision.

Selling your home can provide you with immediate cash, allowing you to pay off the debt more quickly and efficiently. Additionally, it can help eliminate any further financial burden on yourself or your family.

However, selling your home also has its drawbacks. You may have to take out a loan in order to purchase a new property or rent an apartment or house, increasing your overall financial burden.

And if you haven't paid off all of your debts before selling, creditors may still come after you for payment. It's important to carefully consider both sides before making a final decision so that you can protect yourself and your family from further financial hardship in Oregon.

Defaulting on a mortgage due to medical bills can have serious legal consequences in Oregon. Homeowners should always be aware of the potential ramifications when dealing with medical debt and the legal steps that could be taken if they are unable to make payments.

If someone defaults on a mortgage, it is possible for their home to be foreclosed upon and for them to face other penalties, such as wage garnishment or liens placed against their property. To protect themselves from these potential consequences, borrowers should understand the rules surrounding medical debt and mortgages in Oregon.

This includes the ability to negotiate with the lender or seek out alternative payment plans that may help keep them in their home while still paying off medical bills. It's also important to know whether or not medical debt can qualify for bankruptcy protection, as this can provide some relief from immediate financial obligations while providing an opportunity to negotiate long-term solutions with creditors.

Knowing these rules is essential for anyone struggling with medical debt who wishes to remain in their home while repaying their debts.

Bankruptcy can be a powerful tool to help save your house from medical debt in Oregon. By filing for bankruptcy in the state of Oregon, you can eliminate or reduce your medical debts and protect your home from creditors.

In some cases, it may even be possible to discharge the entirety of your medical debt, allowing you to keep your home free and clear. Many people worry that filing for bankruptcy will mean they will lose their home, but this is not necessarily true.

In fact, with the right strategy and advice from an experienced lawyer, you may be able to keep your home even after filing for bankruptcy in Oregon. It is important to understand both the state laws regarding medical debt as well as the federal bankruptcy laws so that you can make informed decisions about how best to protect yourself and your home from medical debt.

An experienced lawyer can provide sound legal advice and guide you through the process of filing for bankruptcy in order to ensure that you take advantage of all available options for protecting your home from creditors.

For those in Oregon facing medical debt, refinancing a mortgage can be an effective way to manage the financial burden. Homeowners should understand the options available for refinancing their mortgage to pay off medical bills.

Refinancing means taking out a new loan with different terms and conditions than your current loan, which can often be beneficial when faced with high-interest medical debt. If refinancing is an option, homeowners should know that they can use existing equity to cover the cost of medical expenses while potentially lowering their monthly payments.

Additionally, borrowers can benefit from longer repayment periods and lower interest rates when they refinance to pay off medical bills. When exploring this option, it’s important to consider all associated costs such as closing fees and other possible charges.

It’s also important to compare lenders and understand all terms before signing any agreements or contracts. With research and understanding of the rules, homeowners in Oregon can better protect themselves from medical debt by exploring refinancing options for their mortgage.

Oregonians facing medical debt can take advantage of a variety of insurances to reduce or cover unpaid expenses. Many health insurance plans are available, so it is important to research and understand the different coverage options that may be available.

For example, Oregon's Medicaid program provides limited financial assistance for medical costs not covered by other insurance plans. Additionally, Medicare can provide coverage for those over 65 or those with certain disabilities.

There are also supplemental policies available that offer additional protection against unexpected costs beyond what a standard policy may cover. It is also important to know that some employers may have group health insurance plans in place that could be used to help pay for some medical costs.

Furthermore, Oregon residents should consider looking into long-term care insurance policies and disability income protection as well as other supplemental policies such as dental and vision coverage to ensure they are adequately protected against medical expenses. Finally, any state and federal tax credits or deductions that could help cover the cost of medical treatments should be taken into account when evaluating financial options.

Navigating medical debt can be a stressful and overwhelming process, but Oregon residents have access to government programs that may help them manage their unpaid expenses. Understanding the rules of these programs is essential when it comes to protecting your home from medical debt.

Medicaid is a joint federal-state program that provides health coverage to certain eligible individuals and families with low income and resources. In Oregon, coverage is provided through Oregon Health Plan (OHP) which covers people under the age of 65 who meet specific financial eligibility requirements.

Eligible applicants can receive assistance with a number of different services such as doctor visits, hospital stays, prescriptions, mental health care, vision care and more. Additionally, Oregon has an Uninsured Motorist Assistance Fund which helps cover uninsured motorist bodily injury costs for those injured in an automobile accident in Oregon who are unable to collect from any other source.

Finally, the Health Care Uncompensated Care Pool assists hospitals and providers by helping to cover costs associated with providing medical services for uninsured and underinsured patients. Overall, understanding the ins and outs of government programs can help Oregon citizens protect their homes from medical debt by providing financial assistance for unpaid medical expenses.

Non-profit organizations in Oregon are available to provide financial relief for unpaid medical bills, allowing individuals and families to avoid the stress of significant medical debt. Some of these organizations actively work with healthcare providers to negotiate an affordable repayment plan or even a partial or full reduction in the amount owed.

Additionally, certain non-profits can provide resources that cover the cost of medications, transportation, and other necessary medical supplies and services. Organizations like FamilyCare Health help low-income families in Oregon access health care coverage and assist them with understanding their insurance plans.

Other local organizations, such as CareOregon and Central City Concern, offer assistance with paying existing medical bills and provide helpful resources to those struggling with medical debt. Finally, some programs may be available through your state's Department of Human Services that could potentially provide assistance or guidance when dealing with unpaid medical bills.

Exploring all of these options is essential for protecting your home from medical debt in Oregon.

Low-income households are particularly vulnerable to the burden of unpaid medical bills. With limited resources and income, it can be difficult for them to budget for unexpected costs associated with medical care.

This is especially true in Oregon, where the cost of living is higher than the national average. Even those with health insurance may find themselves facing large out-of-pocket expenses due to high deductibles or co-pays.

For many, these medical bills can quickly become unmanageable, leading to a cycle of debt and anxiety that can be hard to break out of. To help protect their homes from medical debt, low-income households must understand the rules and regulations specific to Oregon regarding payment plans, collection practices, and other financial assistance options.

Knowing their rights and how they can take advantage of them can provide some peace of mind in an otherwise daunting situation.

When it comes to understanding the timeline of a lender taking possession of your home due to unpaid medical expenses in Oregon, it is important to know the guidelines set by the law. Homeowners are given a period of at least 90 days before a lender can start foreclosure proceedings.

During this time, lenders are required to work with homeowners in an effort to try and develop an alternate payment plan that will allow them to stay current on their mortgage payments. If borrowers cannot come up with a payment plan that works for both parties, then the lender may proceed with foreclosure proceedings after the 90-day period has elapsed.

It is important for borrowers to understand their rights when it comes to protecting their homes from medical debt in Oregon and take steps as soon as possible if they feel they may not be able to keep up with their monthly mortgage payments due to unpaid medical expenses.

Before scheduling a no-obligation cash offer from HomeGo, it is important to prepare yourself and understand the rules of protecting your home from medical debt in Oregon. Knowing what documents to bring, what information is needed, and having an understanding of the process can help ensure that you are getting the best possible deal while protecting your home.

It is essential to research what type of documentations lenders require when making a loan agreement, as well as check with credit agencies for any discrepancies on your report. Additionally, make sure you understand the timeline of repayment and whether or not a payment plan is available.

Lastly, be sure to review all contracts carefully before signing and be aware of any fees associated with the loan so you can make an informed decision about how to protect your home.

When entering into a cash offer agreement to protect your home from medical debt in Oregon, there are several important factors to consider. First, it is important to understand the laws and regulations that govern such agreements in the state of Oregon.

Researching local laws can help you determine whether or not a cash offer agreement is allowed and if any restrictions apply. Additionally, understanding the terms and conditions of any agreement can help ensure you are adequately protected.

It is also essential to consider the financial implications of entering into a cash offer agreement, such as what amount of money you will be able to receive in exchange for your property and how long it will take for payment to be received. Furthermore, researching potential lenders and their policies can help you make an informed decision about who should provide the financing for your cash offer agreement.

Finally, understanding any tax ramifications associated with entering into a cash offer agreement can help you avoid unexpected costs later on. Taking all of these considerations into account can help ensure that the terms of the agreement are fair and beneficial for both parties involved.

When considering ways to get out of medical debt in Oregon, a cash offer service can be an attractive option. A cash offer service is usually the best way to pay off large sums of medical debt quickly and without hassle.

The benefit of using a cash offer service is that it allows you to make a lump sum payment that covers the entire amount owed, so you don’t have to worry about monthly payments or long-term interest rates. Additionally, some services may provide additional benefits such as waived fees or lower interest rates.

However, there are potential drawbacks to using this approach such as the possibility of paying higher than market value for the debt and not being able to negotiate terms with the creditor. After accepting a cash offer, it is important to understand what happens next.

Usually, after signing off on a payment plan with the creditor, they will send you confirmation paperwork which should include details on when your payments are due and the total amount due. It is also important to explore other resources for coping with unpaid medical expenses such as grants or financial aid programs offered by local organizations or state agencies.

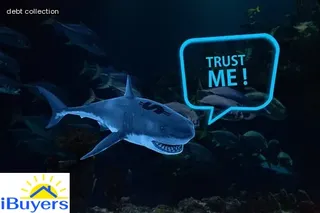

In Oregon, not paying medical bills can have serious consequences. If you don't pay the bills or make a payment plan, your credit score will be affected negatively and collection agencies can pursue legal action against you.

Depending on the situation, the collection agency might even sue you in court. In addition, if your debt is transferred to a debt buyer, they may seek to garnish your wages or file a lien against your property.

Oregon law also allows creditors to place liens on bank accounts and other assets as well as put an administrative freeze on them until they are paid off. Finally, unpaid medical debts may result in your hospital privileges being suspended or revoked.

It's important to understand all of these potential consequences before deciding whether to proceed with ignoring medical debt in Oregon.

Oregon state law protects consumers from medical debt in multiple ways. First, Oregon law requires that medical bills must be itemized and acceptable charges must be clearly stated on the bill.

This allows consumers to understand exactly what they are being charged for and make informed decisions about their payment options. Additionally, Oregon law prohibits creditors from garnishing wages for medical debt without a court order.

Finally, Oregon also has statutes of limitations on medical debt. This means that creditors have a limited time period in which to collect unpaid medical bills before the debt is considered uncollectible.

By understanding the laws in place, consumers can better protect themselves from crippling medical debt in Oregon.

In Oregon, the statute of limitations for medical bills is six years, beginning from when the debt was incurred. This means that creditors have six years to take legal action for debt collection purposes.

With this in mind, it's important to understand the rules and regulations surrounding medical debts in Oregon. To protect your home from medical debt, it's critical to be aware of the state's statute of limitations - six years in this case - as well as other relevant laws and regulations governing healthcare debt.

Knowing these rules can help you make informed decisions about how best to protect assets like your home from creditors pursuing medical debts in Oregon.

In Oregon, medical debt is subject to the same statute of limitations (SOL) as other forms of debt. The SOL on a debt is how long a creditor can legally sue for repayment.

Generally, the SOL for medical debt in Oregon is six years from the date of delinquency or last payment. After this period has lapsed, the debt is considered uncollectible and can no longer be pursued by creditors.

It's important to note, however, that simply because a debt has become uncollectible doesn't mean it won't still show up on your credit report; it just means that you are no longer legally obligated to pay it. By understanding the rules regarding when medical debt becomes uncollectible in Oregon, individuals can better protect their homes from financial hardship due to medical expenses.

A: Generally, no. In Oregon, debt collectors cannot take your house unless they have a judgment from a court that allows it. Even in the case of bankruptcy or judgments, creditors typically cannot seize your primary residence.

A: No, this is illegal according to Oregon Consumer Law and Consumer Advocates.

A: Yes, Community and Charity Care programs can be used to protect a home in Oregon from being taken away due to medical bills for individuals at the Poverty Level.